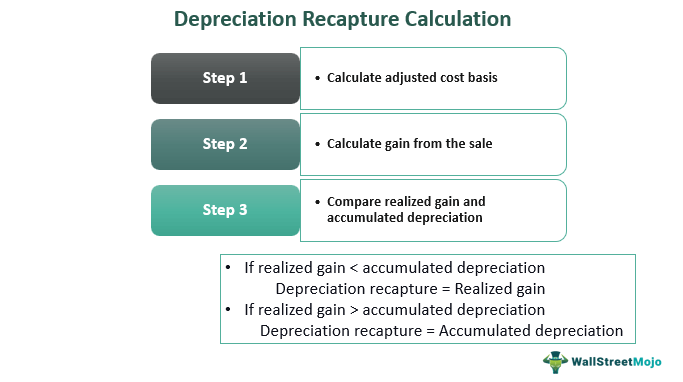

Depreciation recapture formula

Schedule C Form 1040 Profit or Loss From. This is a rare occurrence because the IRS.

Depreciation Recapture Meaning Calculation Tax Rate Example

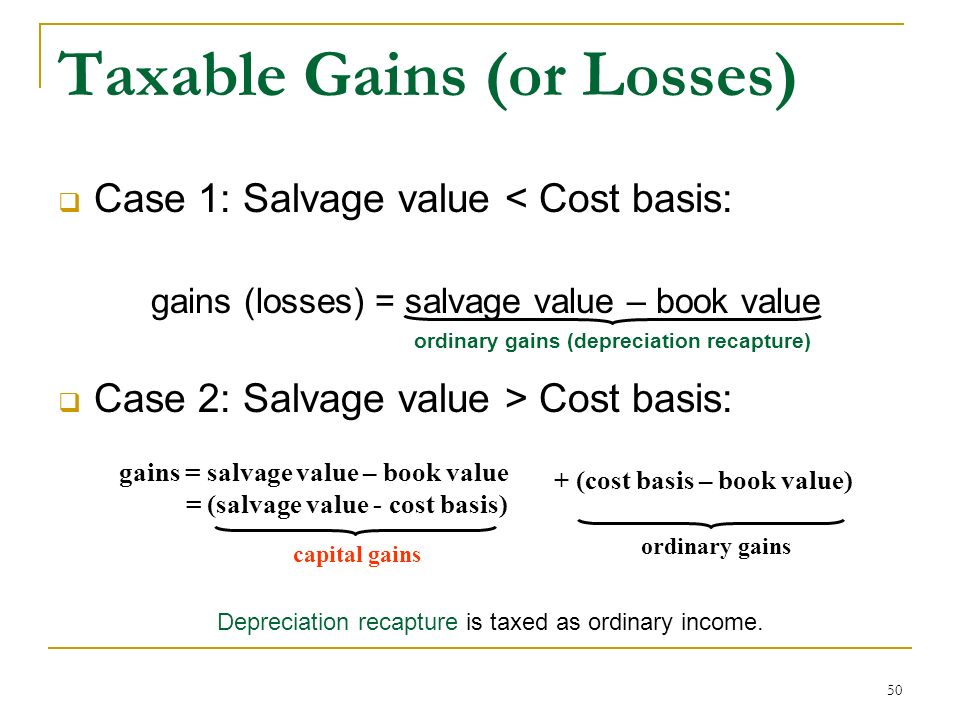

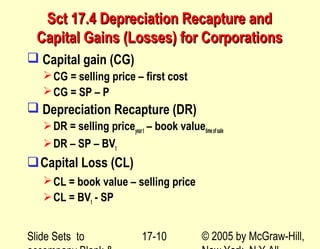

Depreciation recapture tax rates Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to be your.

. Section 1245 depreciation recapture is used to calculate any income tax or capital gains tax you may owe on a sold asset. So between 218180 the accumulated depreciation over twenty years and 368180 the realized gain the depreciation recapture will be applied to 218180. Cost of your property minus the value of the landBasis Basis divided by 139ththe amount you can.

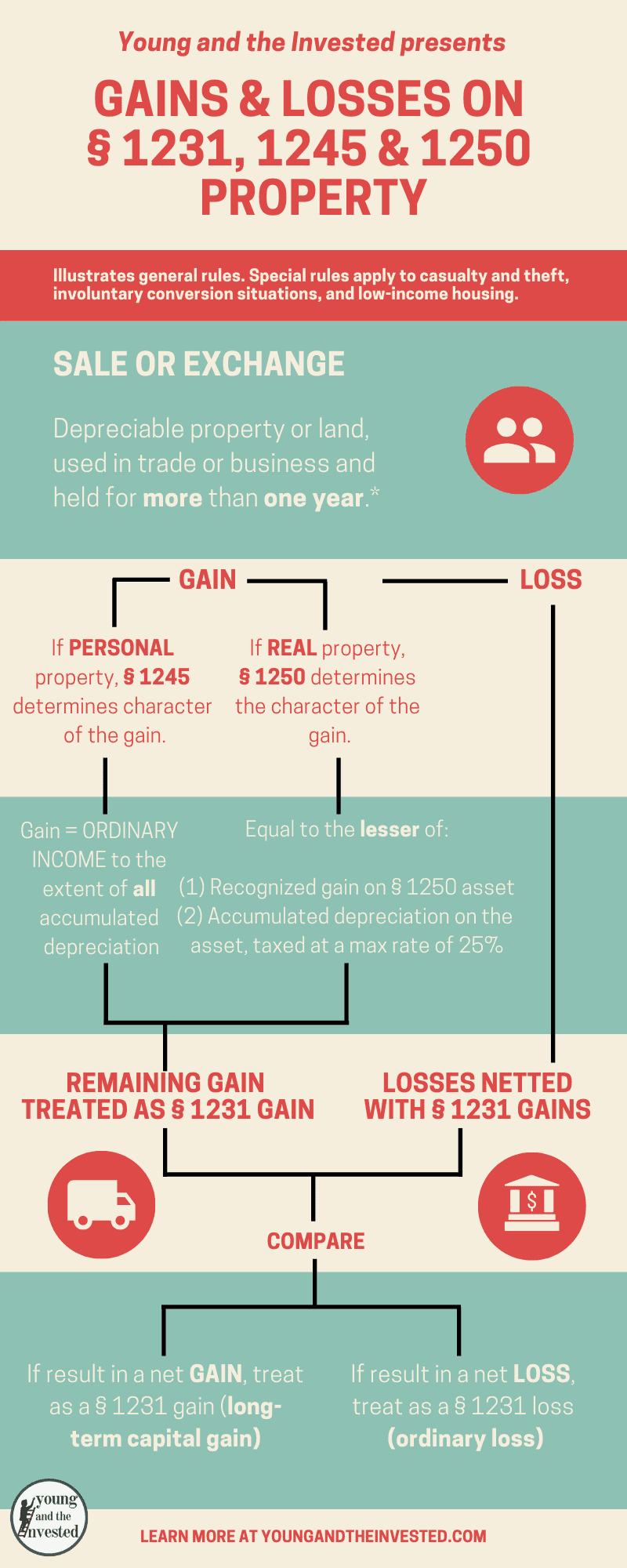

Regular Method - No. The tax rate for the depreciation recapture will depend on whether an asset is a section 1245 or 1250 asset. Examples of Depreciation Recapture.

He subtracts 10000 the lesser of the proceeds of disposition of the property minus the related outlays and expenses. Depreciation recapture is a process that allows the IRS to collect taxes on the financial gain a taxpayer earns from the sale of an asset. In this situation the UCC is also 6000 10000 - 4000.

Learn More About the Types of Property Subject to Depreciation Recapture. Ad Confidently Tackle the Most Complex Tax Planning Scenarios Year-Round. How Depreciation Recapture Works.

In the private equity context to the extent that the cash investors share of the fair-market-value-based depreciation exceeds the total depreciation calculated based on the. You can claim business use of an automobile on. Heres the formula used to determine basis and depreciation on commercial assets.

You can generally figure depreciation on the business use portion of your home up to the. If you use this method you need to figure depreciation for the vehicle. Part of the gain can be taxed as a.

What is depreciation recapture. Recaptured Depreciation Formula The formula for calculation of recaptured deprecation is Recaptured depreciation Selling price of the asset Deprecated value of the. Learn More About the Types of Property Subject to Depreciation Recapture.

You may be able to deduct the acquisition cost of a computer purchased for business use in several ways. Your depreciation recapture gain is 102560. For example if business equipment was purchased for 10000 and had a depreciation expense of 2000 per year its adjusted cost basis after four years would be.

In this instance your capital gain on the property is 152560 102560 50000. Under Internal Revenue Code section 179 you can expense the acquisition. The tax rate will be tied.

What Is Depreciation Recapture. Depreciation recapture is associated with the depreciable property and selling the depreciable property results in the ordinary income and reduces the. Regular Method - No.

All allowed or allowable depreciation must be considered at the time of sale. 6 Multiply your capital gain by the capital gains tax. When an asset is sold at a value above the adjusted basis the gain is taxed as ordinary income up to the amount of depreciation claimed.

Depreciation recapture can cause a significant tax impact if you sell a residential rental property. You can generally figure depreciation on the business use. To calculate this you will start with the cost basis of the item then.

Ad Confidently Tackle the Most Complex Tax Planning Scenarios Year-Round. All allowed or allowable depreciation must be considered at the time of sale.

Chapter 8 Depreciation And Income Taxes Ppt Video Online Download

Chapter 8 Accounting For Depreciation And Income Taxes Ppt Video Online Download

Like Kind Exchanges Of Real Property Journal Of Accountancy

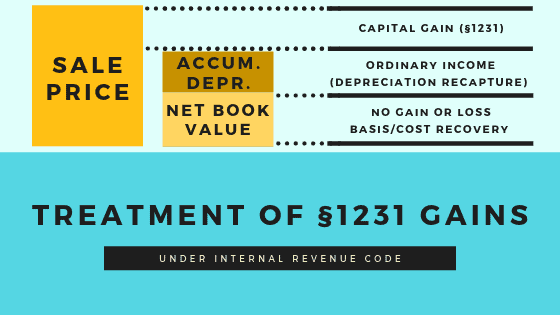

Capital Gains And Losses Sections 1231 1245 And 1250

Depreciation And Income Taxes Prezentaciya Onlajn

How To Use Rental Property Depreciation To Your Advantage

Chapter 8 Accounting For Depreciation And Income Taxes Ppt Video Online Download

Chapter 17 After Tax Economic Analysis

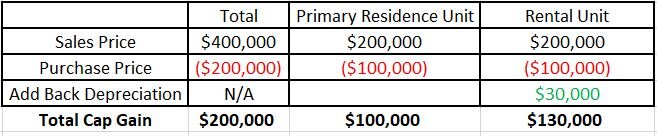

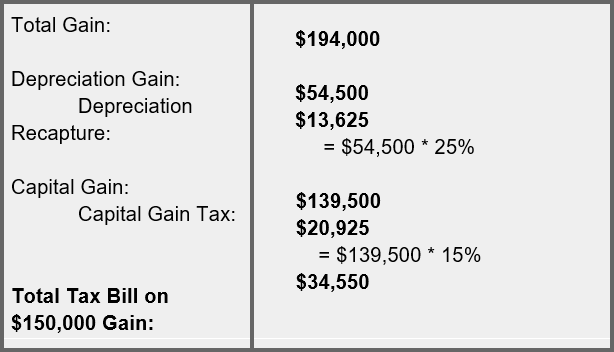

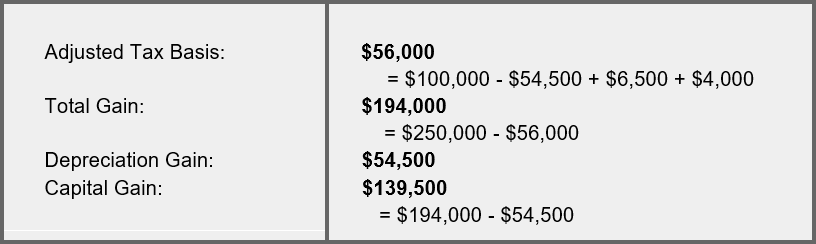

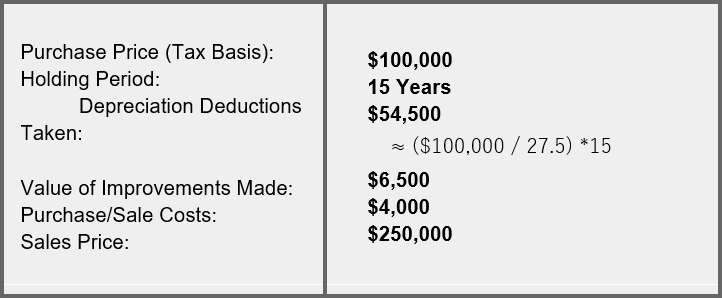

Do I Have To Pay Tax When I Sell My House Greenbush Financial Group

Learn About Depreciation Recapture Spartan Invest

Depreciation Starting With The Basics Ilsoyadvisor

Learn About Depreciation Recapture Spartan Invest

Depreciation And Income Taxes Asset Depreciation Book Depreciation

1031 Exchange And Depreciation Recapture Explained A To Z Propertycashin

Learn About Depreciation Recapture Spartan Invest

Capital Gains And Losses Sections 1231 1245 And 1250

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com